Featured

- Get link

- X

- Other Apps

Nc Paycheck Calculator With Overtime

Nc Paycheck Calculator With Overtime. So the tax year 2022 will start from july 01 2021 to june 30 2022. It will calculate net paycheck amount that an employee will receive based on the total pay (gross) payroll amount and employee's w4 filing conditions, such us marital status, payroll frequency of pay (payroll period), number of dependents or federal and state exemptions).

An employer may choose a higher rate of overtime pay. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. After a few seconds, you will be provided with a full breakdown of the tax you are paying.

Calculates Federal, Fica, Medicare And Withholding Taxes For All 50 States.

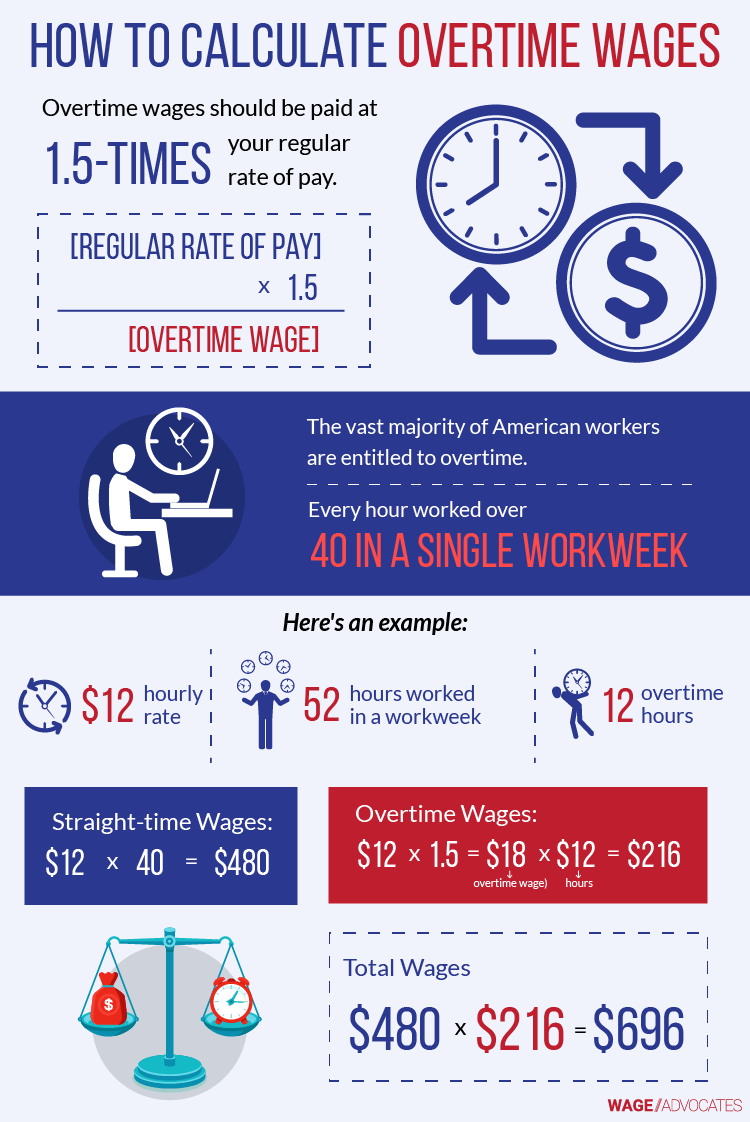

Based on the north carolina minimum wage of $7.25 per hour, the minimum amount any north carolina worker should receive as overtime pay is $10.88 per hour. Therefore, north carolina's overtime minimum wage is $10.88 per hour, one and a half times the regular north carolina minimum wage of $7.25 per hour. $15.00 overtime pay per period:

The Algorithm Behind This Hourly Paycheck Calculator Applies The Formulas Explained Below:

Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest. To use our north carolina salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. Use adp’s north carolina paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees.

It’s Set To Raise The Standard Salary To Over $35,000 Annually.

$290 (40 hours x $7.25 per hour) + $217.60 (20 hours x $10.88 per hour) = $507.60 gross wages. Overtime pay of $15 × 5 hours × 1.5 (ot rate) = $112.50. The median household income is $52,752 (2017).

Some States Follow The Federal Tax Year, Some States Start On July 01 And End On Jun 30.

An employer may choose a higher rate of overtime pay. Any wages above $147,000 are exempt from the social security tax. The new guidelines, which will be effective on january 1, 2020, states the following principles:

To Try It Out, Enter The Employee’s Name And Location Into Our Free Online Payroll Calculator And Select The Salary Pay Type Option.

This calculator can determine overtime wages, as well as calculate the total earnings for tipped employees. Another way of computing overtime pay shown below will produce the same results: Payroll check calculator is updated for payroll year 2022 and new w4.

Comments

Post a Comment